Your Profit Recipe

Where do you stand when it comes to cooking and baking? Do you love following a recipe or do you just kind of wing it with a pinch of this and a little of that? Or do you prefer watching other people do the work as you critique them like the chef you know you are? Who hasn’t given their two cents about a recipe gone wrong on The Great British Baking Show that you just know you could have made better yourself?

I love to cook, and I enjoy following recipes in my cookbooks. When I’m done making the dish, I always write down my rating on the recipe and any notes I have for how I’d like to change it the next time. Building a growing business with scaling profit margins is like following a recipe. There are steps to take to see a favorable result and sometimes, with some tweaks along the way, you can make it even better as you go.

If you hate even the thought of cooking or are one of those people that always seems to screw up the dish even if you followed the recipe perfectly, I promise you the recipe for increasing business profit is one that anyone can follow. Plus there are no pots and pans to wash after because, let’s be honest, sometimes the clean-up is the worst part.

I’ve broken down each ingredient for you in the business profit recipe with an explanation of what it is, why we need it and how it contributes to the final dish - a profitable, scaling business.

DOWNLOAD YOUR FREE PERSONAL PROFIT RECIPE

Your resource for key strategies you can use to increase your profit and take home pay. Plus, get my cash flow process to save for taxes and pay yourself.

Profit & Loss

The first step to cooking up a profitable business is to create a profit and loss statement. A profit and loss statement (P&L) is an internal document, meaning you don’t submit it to the IRS and don’t typically share it outside of your business unless it’s with relevant contractors. When something isn’t a required part of owning a business it can be easy to skip, but a P&L is definitely not an optional ingredient. It’s something you need if you’re really serious about making a profit and scaling that profit year-over-year. Do you have a profit and loss statement? If not, stop what you’re doing, open up a blank document, and let’s dive in.

A profit and loss statement starts with your Revenue as the top line. Underneath your revenue, you will subtract your Cost of Goods Sold. Cost of Goods Sold is different from business expenses (we’ll get to those in a minute). For service-based businesses, you oftentimes won’t have Cost of Goods Sold. An example of Cost of Goods Sold would be if you were a jeweler. What is the cost of the materials that are in that ring or bracelet that you sold? Not the price you sold it for, but the cost of the goods used to make it into that final sellable product.

Revenue - Cost of Goods Sold = Gross Profit, the next line on your P&L. Beneath your gross profit, you’ll break your expenses out by category. Don’t list every single thing you’ve ever bought here, a P&L is not the same as your bookkeeping records, but rather break it down by type of purchase. For example, Educational Material, Home Office Expenses, etc. Add all these categories up to put into your next line, Total Expenses.

From there, we move on to the Owner Profit, which is Gross Profit - Total Expenses. After adding a line for Owner Profit, it’s time to add in a line for Owner’s Salary. Yes, you really do need to pay yourself otherwise what is the point of having a business? Too often I talk to business owners who have gone months without paying themselves. Paying yourself should become a routine process. It’s usually in this line of the P&L where business owners are really taking a hard look at where all their money is going. What do you mean I’m doing $200,000 in sales and only bringing $35,000 home each year?! How much you can pay yourself all comes down to profit, and we’ll get to how you can increase that take home pay beyond just cutting expenses.

To calculate your Business Profit, the next line on your P&L. This is your Owner's Profit - Owner’s Salary. Here we only consider salary paid through a formal payroll processor. This line is a necessary one for tax calculations but is less useful than the owner profit line to show the financial realities of the business.

From there, we’re going to add in a line for our Tax. This is the total of non-deductible taxes paid. We really only put federal and state income taxes here.

The final line on our P&L is Take Home Pay. You will find your Take Home Pay by calculating Owner Profit - Tax. If you are not happy with your Take Home Pay, keep reading for how to increase your profit.

Marginal Profit

Your marginal profit is the profit you make per offer. If you’re a business with multiple offerings, it’s important to have an understanding of which offer(s) are generating the most profit or if they are even all profitable. Many business owners begin to rethink their offerings once they have a better understanding of their marginal profit.

For example, if you’re a wedding planner, you may find that your full planning services generate more profit than your day-of coordination services and therefore you might decide to focus solely on offering full planning services so you can optimize the efficiency of that process and increase profit.

Scaling Versus Flailing

When reviewing your profit and assessing its growth, it’s important to ask yourself the question, “Am I growing, scaling, or flailing?” Just because you’re turning a profit doesn’t necessarily mean your business is on track for continued success.

Growing

If your revenue is increasing while profit margin remains the same, you are growing. An increase in revenue is great, especially if your related business expenses are not growing at a higher rate than the revenue. So often it’s easy to start spending more money as we get more money, leading to a stagnant profit margin, even as we bring in more revenue.

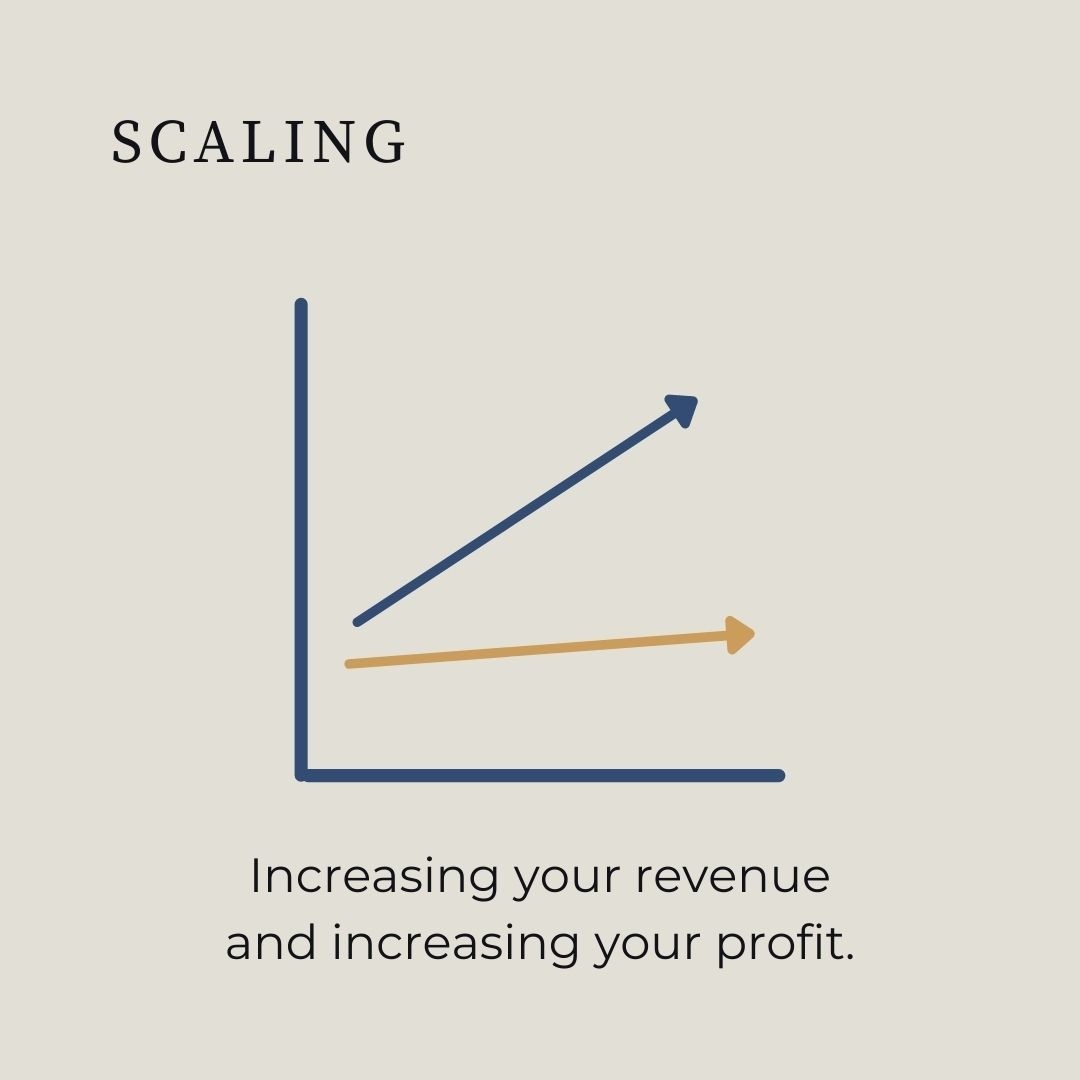

Scaling

Scaling increases your revenue while increasing your profit margin. This is one of the most important parts of your profit recipe because scaling your business is the ultimate goal. You are making more revenue at a faster rate than the rate in which your expenses are increasing. This gives you a larger profit margin.

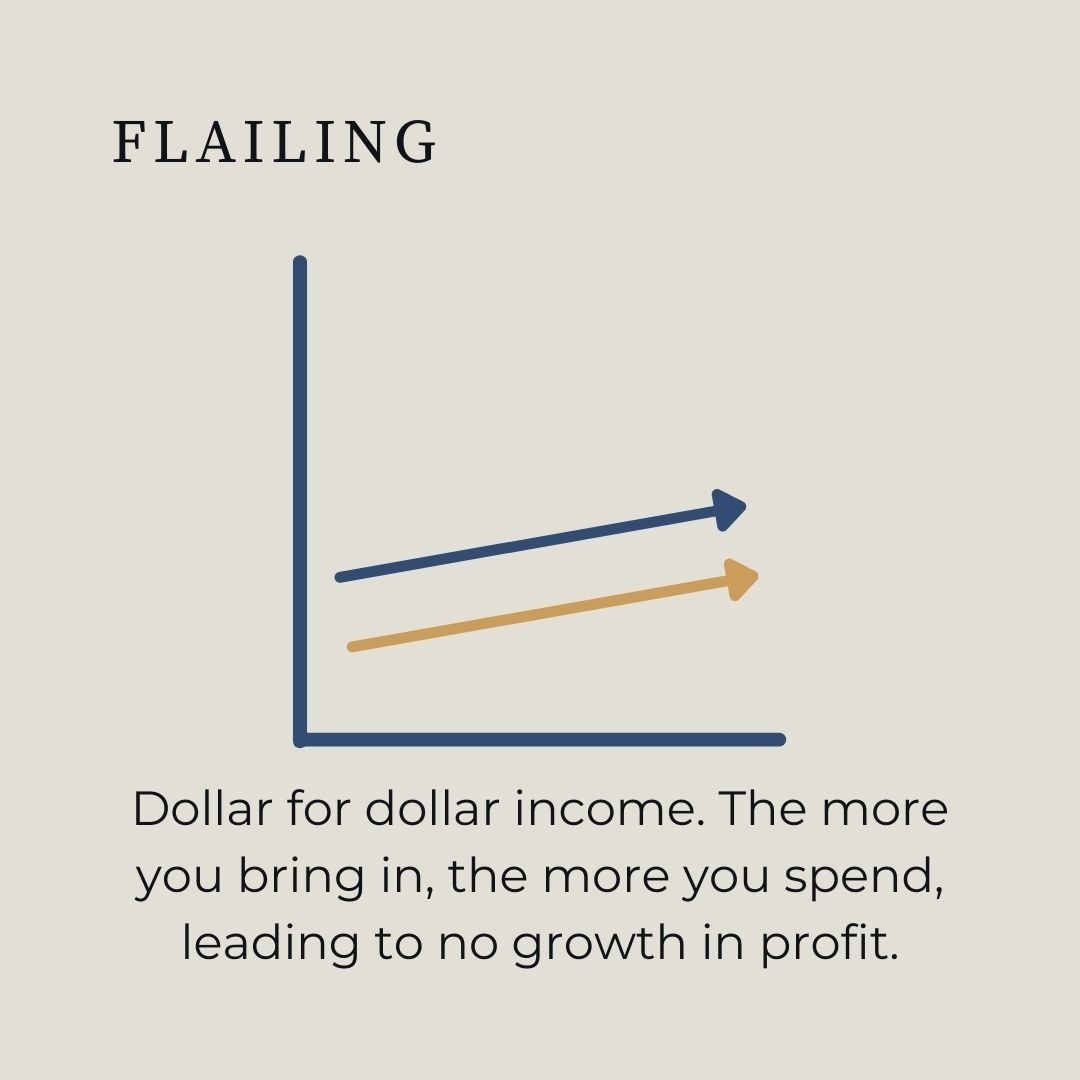

Flailing

Your revenue may be increasing, but so are your expenses, dollar for dollar. It can seem like you're making money, but your profit margin is not growing or, worse yet, getting smaller as you make more money and spend more money.

If your business is flailing, take a hard look at what expenses you can cut. I’m not saying cut every expense. Some business expenses, like your CRM for example, can allow you to streamline your processes and work more efficiently, making the pay-off worth it because time has value.

Goal Profit Margins

Obviously, the goal of your business is to be making a profit. Cheers to you if you are making a profit over a loss in your business. The more profit you make, the more money you will have available for take home pay.. An ideal profit margin goal is around 70%, but this definitely varies by type of business. Your profit margin is the ratio of profit remaining after calculating (Total Revenue - Total Expenses) divided by Total Revenue. The answer to that problem begs the question - are you making as much profit as you possibly can be? Let’s find out.

Optimizing Profit

Is your business generating as much profit as possible? At first glance, it’s easy to say “yes, of course I am Braden because if it was that easy I’d just be making more profit.” The truth is, oftentimes there are areas of our business we are overlooking that can lead us to a higher profit.

Increase Revenue

What else can you offer in your business that will increase your revenue? Maybe it’s a digital product or a VIP day to work 1:1 with a client. Maybe it’s increasing your prices, especially the price of your most common package or most popular offer.

Decrease Expenses

Take a hard look at all of your expenses. What do you pay for that you don’t actually need, use or benefit from? That social media scheduling tool you never use? That design program you haven’t taught yourself to use and probably won’t? Not every expense needs to be cut. In fact, some expenses may come with a high price tag but save you significant time in your business, making them totally worth it.

Change Your Revenue Mix

After you’ve reviewed your marginal profit and assessed what offerings bring in the most profit, it’s time to review what you offer and how that aligns with what parts of your business you enjoy. Is one of your offerings generating little to know profit? Cut it, or reposition it so it brings in more revenue and is something you enjoy.

With any method of profit optimization you choose, make sure you are correctly calculating (and making) your quarterly estimated income tax so that your profit is accurate and you don’t find yourself over or underpaying your taxes.

Get Your Prescription for a Healthy & Wealthy Business

Say goodbye to income inconsistency, tax anxiety, and legal panics and hello to a profitable, stable business.

Join the ProfitRxThe Final Dish

And there you have it. Mix together an updated profit & loss statement, keep an eye on your marginal profit, assess if your profit margin is scaling or flailing and top it off with some profit optimization and you’ve made yourself a profitable business of your very own!

CAN WE BE BESTIES?

Have questions on the blog? Need more small biz friends? Join the Facebook Group, Braden's Besties to connect.

SIGN ME THE F UP