Have you contemplated forming an LLC, but you're worried you'll f*ck it all up?

Have you heard horror stories about liabilities and lawsuits that keep you up at night?

I get it. Legal stuff for your small biz can feel like a whole new language -

one you’re definitely not interested in learning.

And the internet is a whole home mess of contradictions and confusion.

But you know that, to make your biz legit, you need to know your shit. ENTER . . .

Sole Prop -> LLC, a straightforward course that'll teach you how to take the next step in your business.

Here's what I typically see from creatives when they go to legally form their businesses.

1. They just don't do it,

which is a big yikes. You're just asking for trouble.

2. They DIY,

and save some money but don't have the peace of mind that comes with knowing everything has been done correctly.

3. They go with a service like Legal Zoom,

and overpay for certain services, don't get other stuff they need, and don't get educated on WTF is even happening.

Ok, but why even bother with an LLC? It's all about the layers of protection.

Here's an excerpt from the Sole Prop -> LLC course textbook to explain.

I describe different legal and tax checkboxes as layers of protection for your business. Imagine you’re someplace frigid like that scene in Titanic with Jack and Rose, except you’re floating along in your own boat.

Picture your clothes. What are you wearing? Are you cold? Actually take about ten seconds to think about it. Maybe you’re in a light sweater and jeans, and you have a blanket. You’re still freezing and uncomfortable, but you feel protected enough to maintain your health. Or maybe you’re fully ready to scale Everest.

Consider the layers of legal protection like clothing in the cold. There’s a minimum you can get by with, but the weather could turn even colder. At that point, you may need more protection. The more layers you have, the more protected, insulted, warm, and cozy you—and your business—are.

Also consider how you normally feel. Do you run warm or cold? You may need more or fewer layers of protection. Like a person who may be colder than most, most of the time, a risk averse person may want more layers than the care free and warm leaning types. In other words, the number of layers we need will depend not only what's objectively reasonable but what will also make ourselves feel a bit more secure. If you want all the insurance to help you sleep better at night, great! It'll likely be worth the investment for you.

I love this analogy because it fits in nicely with my personal philosophy, which is that it’s not my job to tell you exactly what you have to do.

Rather, I share what I think the essentials are, how much they cost, and how they will protect you. Then, you can choose how many of those layers you want to cloak your business in.

The first layer is your contract. Contracts lay the ground rules.The second layer is your insurance. Ideally, if you're ever sued, your insurance will pay for your legal defense and payout any claims. Should these first two layers fail or be insufficient, the LLC is your last layer of defense to protect your personal assets.

And the good news is that forming an LLC isn't all that complicated.

-

You don't need a pricey attorney to do it. And you don't need a boring accountant.

-

LLC formation is really just a few simple steps. So why go through a full course you may ask . . .

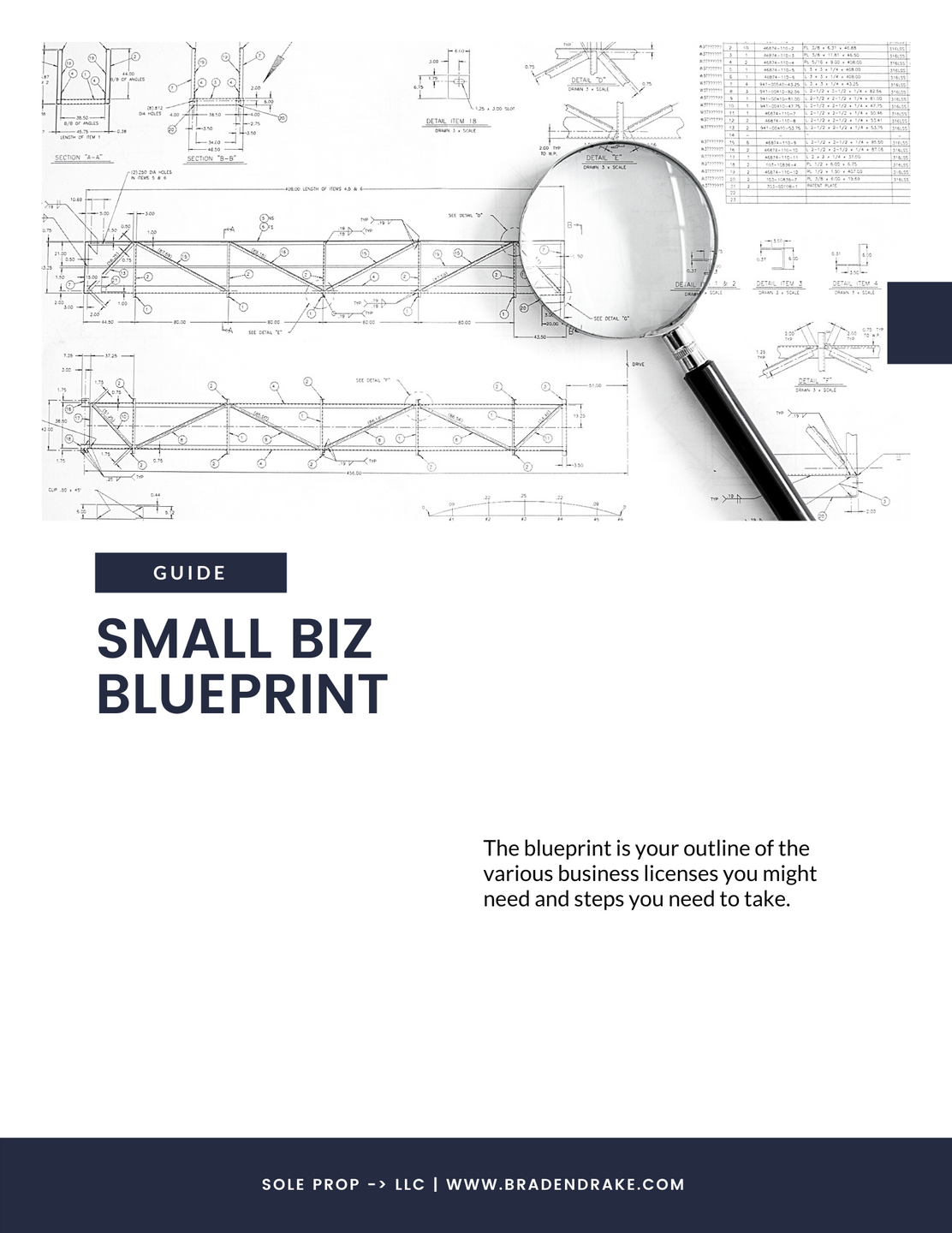

You need to go through the full Small Business Blueprint to make sure your LLC is actually functional.

When you form an LLC you're creating an entity separate from yourself. This requires you to:

- Update your business license, seller's permit, and DBAs;

- Create an operating agreement and meeting minutes to maintain your required "corporate formalities;"

- Open new bank accounts in the name of the LLC; and

- Maintain your LLC with regular filings like statements of information and franchise tax payments.

Failure to maintain these steps properly can lead to financial penalties or the LLC being involuntarily dissolved. Yikes.

But not to fear, we have the solution . . .

Ready to Join!?

Click the image to the left to get signed up.

Have Questions?

Post in the Facebook Group or Shoot me a DM on Instagram. I'd love to chat.

Sole Prop -> LLC is a 4 lesson course to teach you how to form and manage your LLC (or S corp). You can get through the full program within a week.

In Lesson 1,

You'll learn all about business liability and how LLCs work alongside the other layers of protection to protect both you and your business.

In Lesson 2,

I teach you all about business names and DBAs. We discuss how to form your business when you have multiple names, revenue streams, or, potentially, multiple businesses.

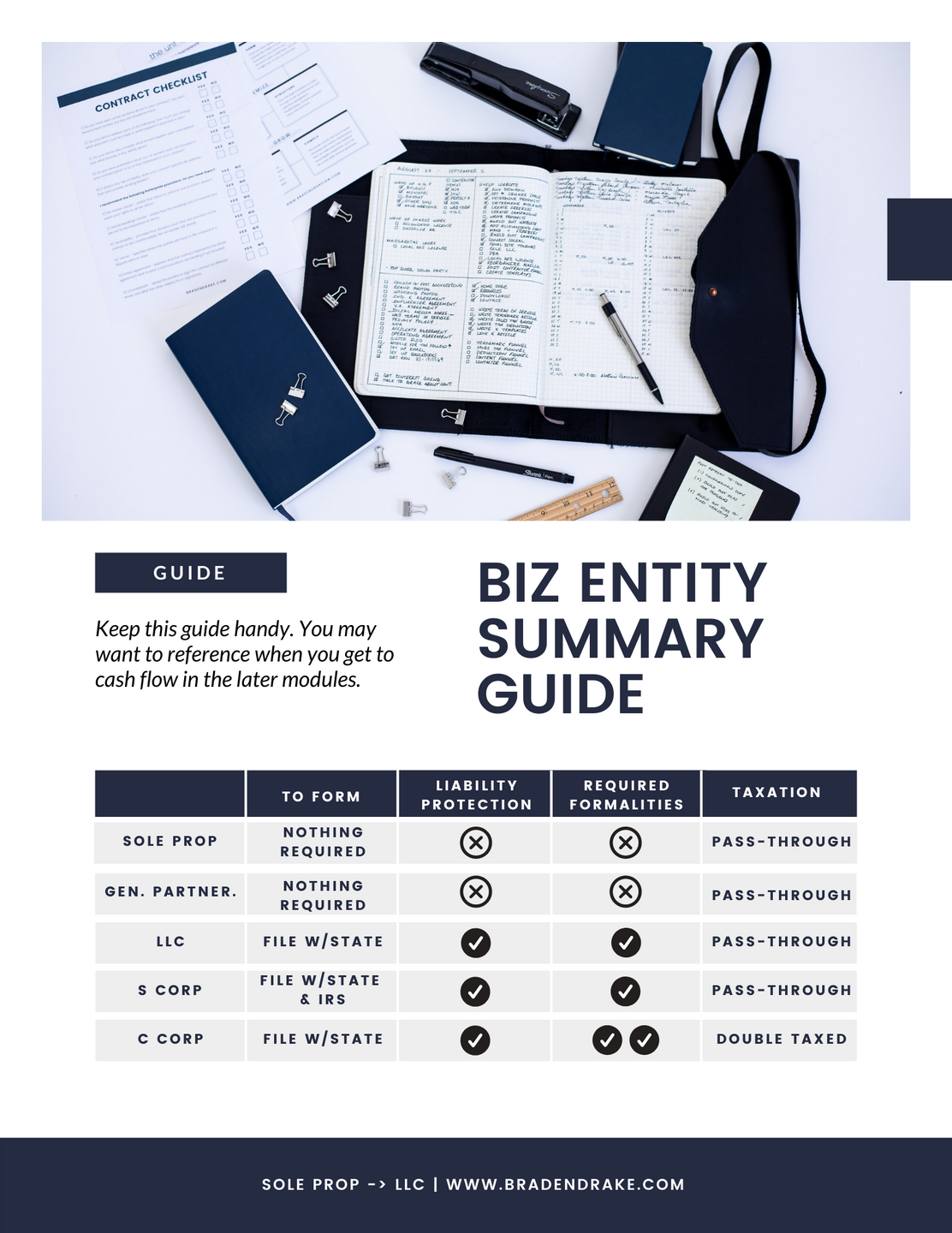

In Lesson 3,

We dig into taxes. I'll explain the differences between pass-through entities and disregarded entities. You'll learn how S Corps actually work, and what different entities will mean for your tax bill.

In Lesson 4,

I'll walk you through the full, 14 step Small Business Blueprint. You'll determine which steps you need to take and then follow my video tutorial to form your business entity.

How It Works:

First, you'll watch a 10ish minute video training for each lesson.

Then, you'll read the corresponding lesson in our course textbook and do the exercises in the guides.

Lastly, you'll watch my tutorial videos to learn how to file each application or document you may need to file.

Here's a sampling of our course textbook:

FAQs

Hey girl, how much is this gonna cost me?

What are all the benefits?

Is there any support?

Ready to Join!?

Click the image to the left to get signed up.