Let's start with an intro

Taxes. No one really loves them, but we all gotta pay them. It’s pretty simple when we have an employer. They direct deposit our paychecks, but before the money hits the bank, a chunk is taken out to pay state income taxes, federal income taxes, and Medicare and Social Security taxes.

Once we become self-employed, we have to take care of our own taxes. Through helping small business owners, I have found there’s a bit of a disconnect once entrepreneurs go out on their own. When taxes are automatically taken out, we may not really have an appreciation for how much tax we owe, and how the whole system works.

How taxes are calculated

Here’s a short breakdown:

First, we have to consider federal income taxes. Here’s the simplest way I can explain how we calculate federal income tax. I’ll leave some info out to streamline it.

Figure your net business income (income minus deductible expenses)

Add any other income (income from another job, spouses jobs, stock sales, rental income etc.)

Subtract the federally allowed standard deduction

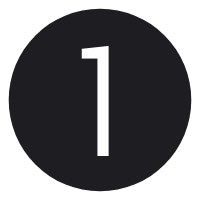

Then, use the below tax bracket to calculate your tax.

Please note that these brackets change and update each year.

Quick Note on How Tax Brackets Work

So I have found that most of us don't intuitively know how tax brackets work. I didn't until I had a tax professor explain it. Assume you're unmarried and have taxable income of $39,475. Check out the bracket above. You'd be in the 22% bracket. The way the table works is your first $6,699 is taxed at 0%. The money between $9,700 and $39,474 is taxed at 12%, and only that last dollar is taxed at 22%.

Ok, Back to How Taxes Are Calculated

State income tax is pretty much calculated the same. The difference is that the tax rates across the board tend to be much lower. Usually, most of the brackets are under 10%. Some states have no income tax.

Collectively, we call the tax on Medicare and Social Security “self-employment tax,” and I call it SE tax for short. The tax is a flat 15.3% up to around $128,000 and 2.9% thereafter.

Alrighty, Let's Look at an Example

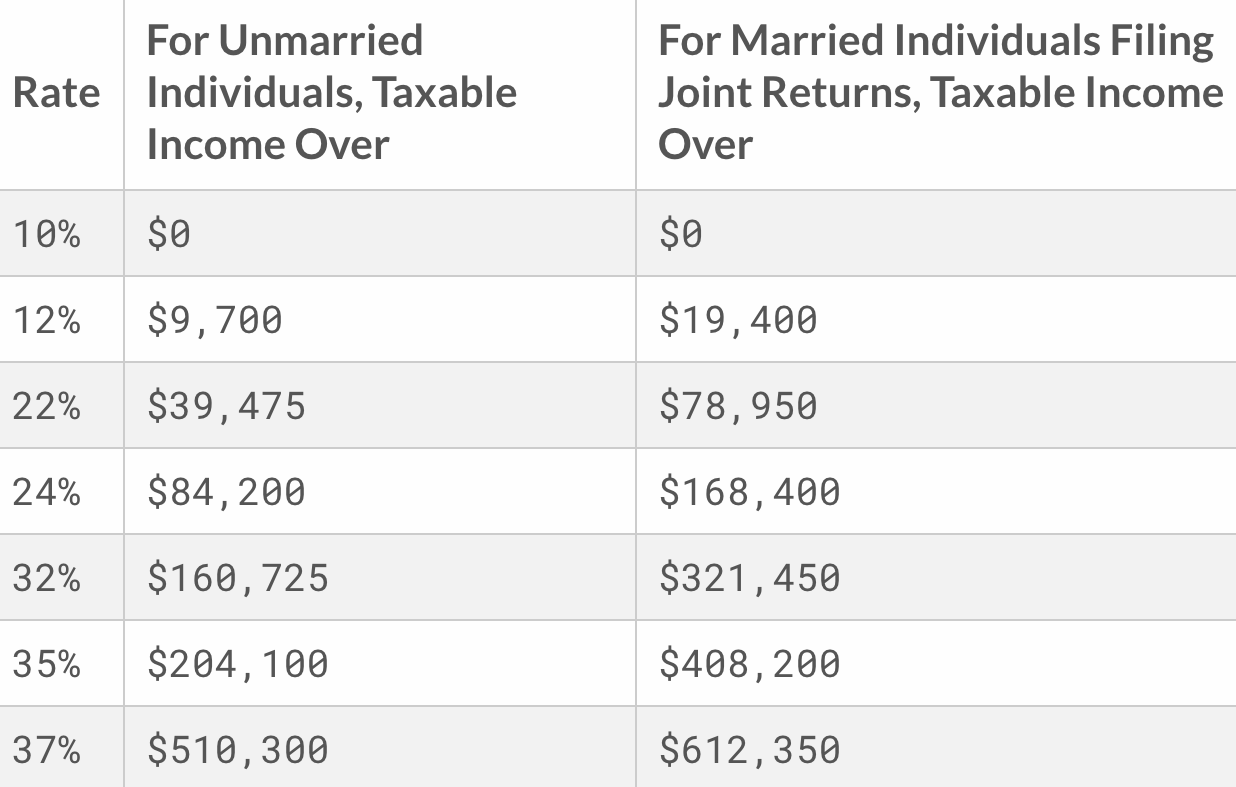

Penny the Photographer made $80,000. She paid second shooters $10,000 and had other deductible expenses of $25,000. Penny also made $3,000 on sales of stock. Check out the below graphic for the example calculation of the three types of tax.

A Few Notes

So the first thing I want to call your attention to is the federal tax owed. The tax amount is $4,130 on $36,000. If you look at the above bracket, you'll see that this taxpayer falls into the higher end of the 12% tax bracket, but when we calculate the tax, it's actually 11.5% of the taxable income after you apply the bracket properly. Us tax pros call this the "effective tax rate." If we assumed our tax payer had taxable income of $39,000, she would fall in the 22% bracket but still have an effective tax rate of around 12%.

The second item I want to note is the amount of state income tax. California is one of the highest tax states, and you'll notice that the tax owed is about 1/4 of the federal tax. This is why I tell clients to set aside a specific amount of money and then pay 80% to federal and 20% to the state.

Lastly, I want to point out the amount of self-employment tax. It's calculated on net business income, and it's a flat rate of 15.3%. This is important for two reasons. First, you don't get the standard deduction to reduce taxable income. Second, the tax rate is not graduated on a bracket. The first dollar is taxed at 15.3% just like the last. I point this out because I'll often file returns for clients who have business profit of around $10,000. After they take the standard deduction, they're taxable income is $0, so they owe no income tax, but self-employment tax is $1,500.

Need some help reducing you taxes?

Dial in your deductions with my Small Business Deduction Guide.

Calculating Your Quarterly Tax

Ok, so now that you know how taxes are calculated, explaining how we're supposed to pay quarterly taxes will be easy(ish).

What the taxing authorities want us to do is estimate our tax for the year, divide it by 4, and then pay that amount in equal installments. Using the table example above, Penny owed $4,130 in federal income tax and $6,885 in self-employment. Both of those taxes go to the IRS, so we can lump them together for a total of $10,988. If we divide that in four, we get $2,747, so Penny should pay that amount each quarter. The same, typically, works for the state.

Finding Your "Savings Percentage"

It's easy peasy (kind of). First, you figure out what percentage of all your business income you need to set aside. Then, you actually set it aside. Take that pool of money, and pay it towards your quarterly taxes on each due date.

Here's how I recommend doing it. Find your total tax for the prior year and then divide that by your GROSS income to find your "savings percentage." Let's look back at Penny. If we add up her three tax amounts the total is $12,045. Her gross income was $83,000 which was her business income before expenses plus her other income (the stock sales). This comes out to a total of 14.5%.

In short, she owed 14.5% tax on her total income. If Penny hopes to make more this year, she can extrapolate and save more.

Therefore, if we assume that Penny's income and expenses will be relatively similar this year, she needs to set aside 14.5% of all of her business income to cover her taxes.

Curious to get a rough guideline of how to actually save the taxes? Checkout the Roadmap download above.

For more info on how to save and pay the tax, check out this blog.

But, Do You HAVE to Pay Quarterly Taxes?

None of us HAVE to pay quarterly taxes, but there is a good chance you may be penalized for not paying them. Here's the actual rule:

If you expect to owe at least $1,000 in tax for the taxable year; and you expect your withholding and refundable credits to be less than the smaller of either 90% of the tax to be shown on your return; or 100% of the tax shown on your prior return (when the prior return covered the whole year).

Take a look at the following example to demonstrate this framework.

Greg, in his second year of business, makes $25,000 from his part-time garage business. He also gets a salary for his full-time job. He owes tax of $10,000 on his total income. Greg has $7,000 withheld from his paycheck for his full-time job. In his first year of business, he owed $8,000. Apply the first part of the rule. Does Greg owe at least $1,000 in tax? Yes. He owes $10,000. Now apply the second rule, which has two parts. Part I: find out what 90% of your tax due would be? Here, Greg’s tax due is $10,000. 90% of that would be $9,000. Part II: find what the total tax due for the prior year was. Here, Greg’s tax due in the prior year was $8,000. The lessor of those two parts is $8,000. Now, we ask whether the amount withheld was less than $8,000. Greg had $7,000 withheld, which is less than $8,000. He must make quarterly tax payments.

If Greg had $8,000 withheld, he would not be required to pay quarterly tax, but it would still be advisable for him to set aside the appropriate percentage of his income to eventually pay the tax.

Let's Talk Penalties

The IRS penalty for late payment is 0.5% per month the payment is late. If you owe $4,000 per quarter and don't make any quarterly payments, the penalty total comes out to around $600 on $16,000 of tax. In other words the penalty is equal to about 3.75% of the tax owed.

I always advise that you definitely want to make quarterly payment, but don't get into credit card debt doing it. Penalties are never ideal but they tend to be quite a bit lower then most other forms of interest, so don't stress out if you're feeling behind.

My Top Tip

Even if you won't be penalized, it's always a good idea to pay your quarterlies. My advice is always this: "You need to save for your tax bill if you if you don't have to pay it in installments on a quarterly basis. If you have to save it, you might as well pay it."

Also, no one wants to file taxes and get a $12,000 tax bill.

The How To

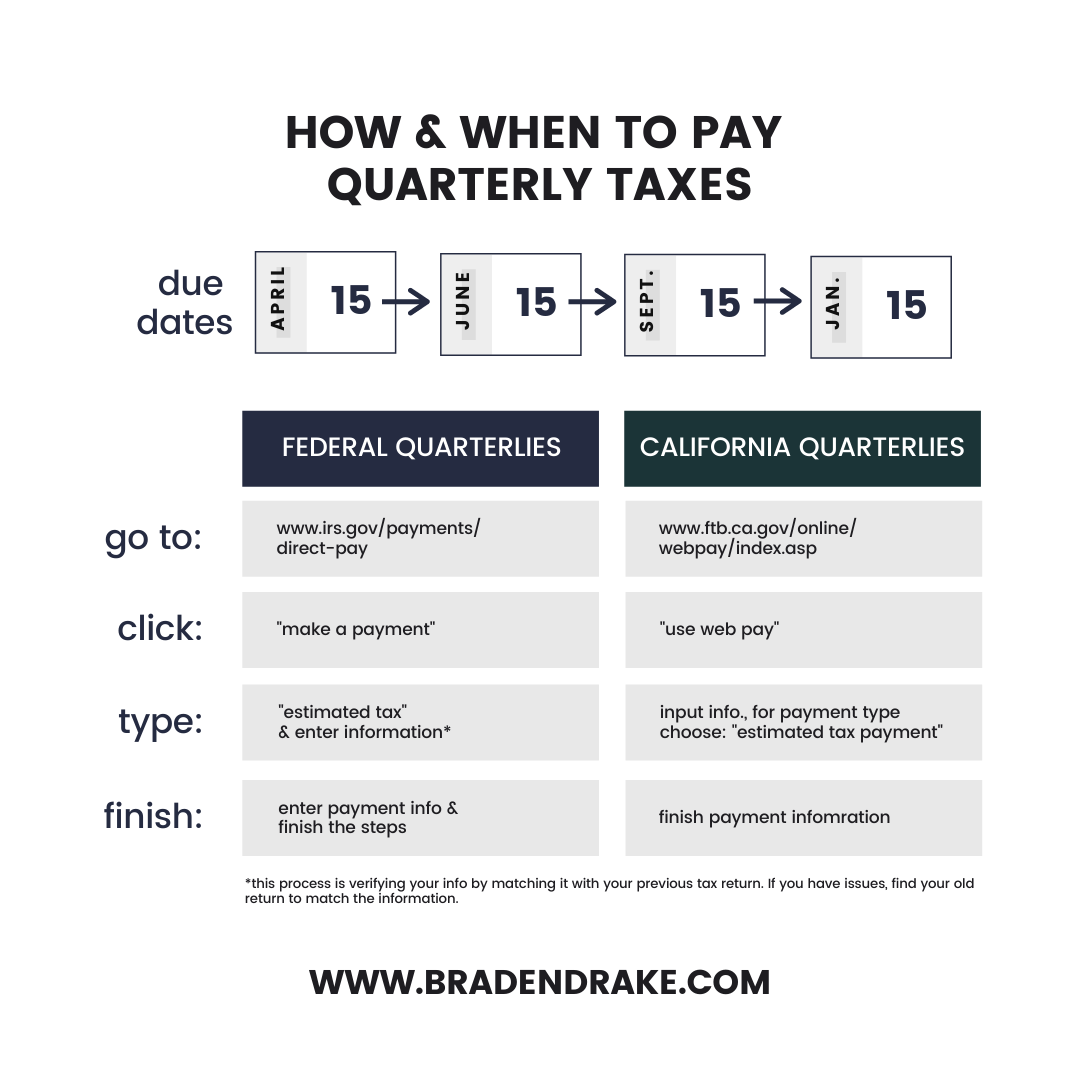

Luckily, once you save the taxes, paying them is really quite easy. You're not filing quarterly taxes. You're paying them. So really, it's not much different than online shopping.

Feel free to print and keep this graphic handy. You can have it whenever you need to pay those quarterlies.

DOWNLOAD THE HOW TOOr, if you'd like more of a tutorial step-by-step, check out this video I made.

CAN WE BE BESTIES?

Have questions on the blog? Need more small biz friends? Join the Facebook Group, Braden's Besties to connect.

SIGN ME THE F UP