Are taxes not the type of drag you bargained for?

I totally get it. Thinking about tax season is enough to make most self-employed folks want to spiral into a sweat induced panic. But it doesn't have to be that way.

When we really break it down, your tax steps to get started are simple:

✅ Keep a simple record of business income & expenses;

✅ Estimate & pay quarterly taxes (in addition to your annual tax return).

That's where the BOD Basics Course comes in.

You'll check off those essentials now with simple, beginner-friendly systems. Your processes can get more sophisticated as you grow.

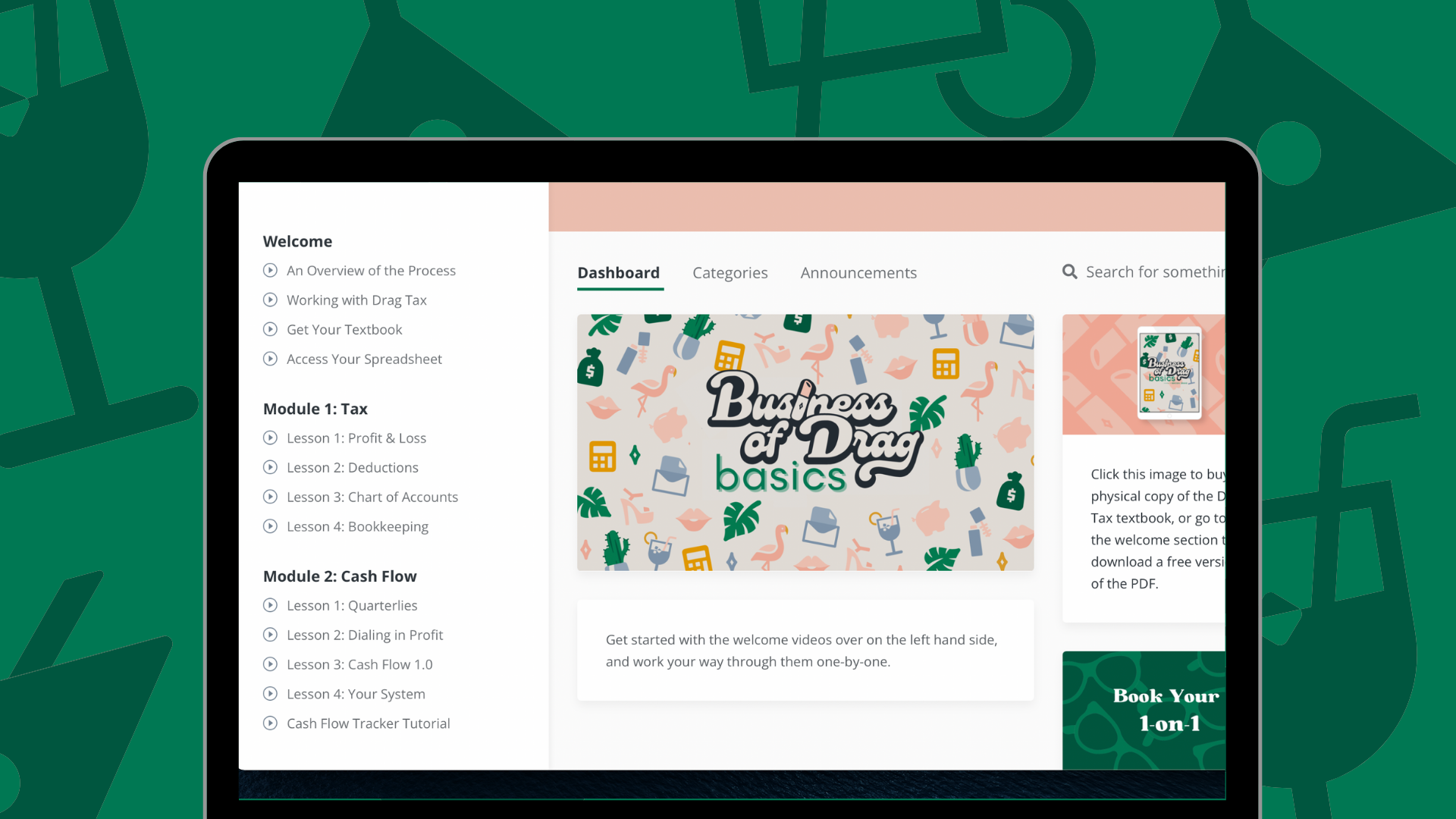

BOD Basics is a simple, 8 lesson course.

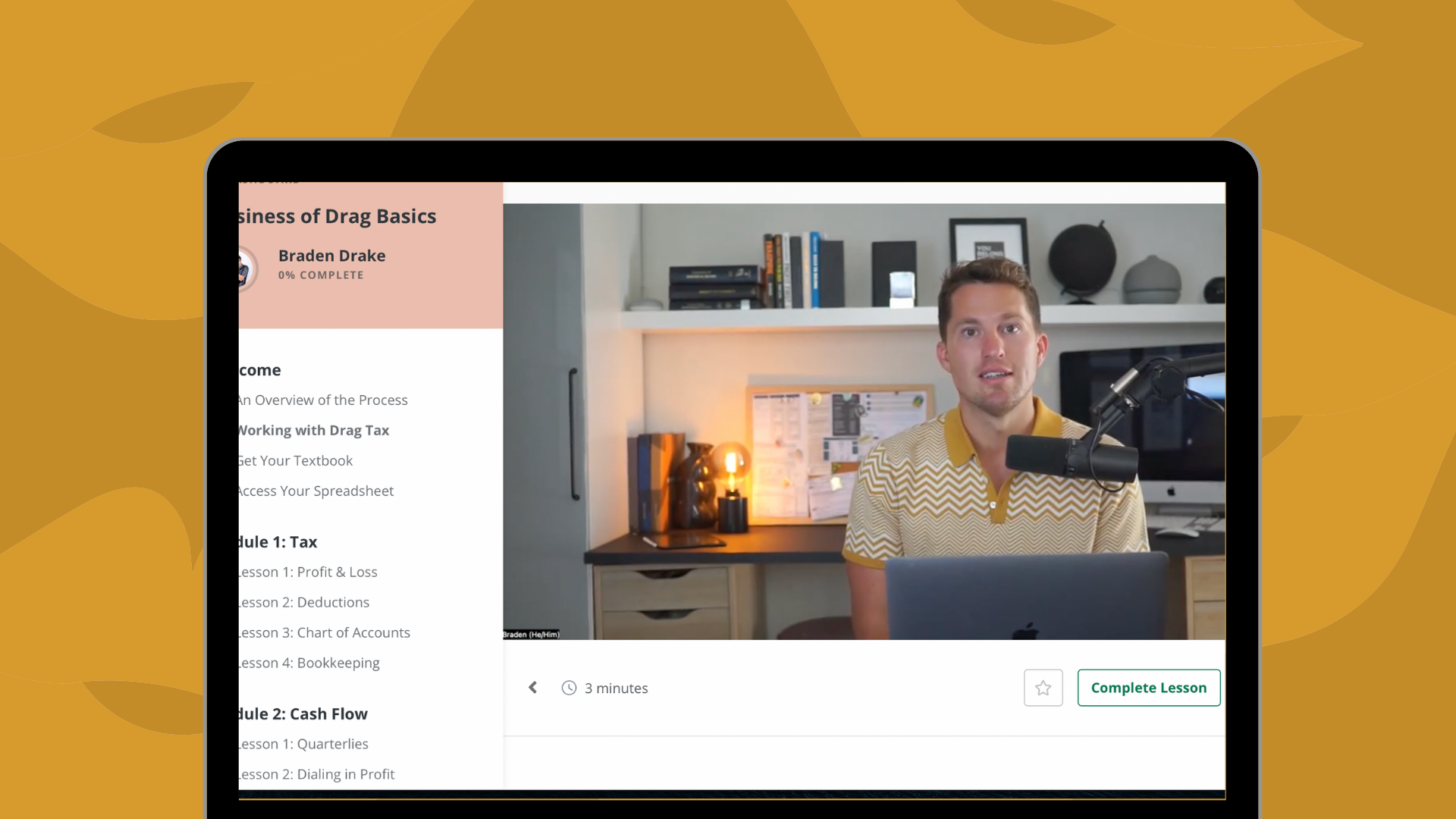

I'll walk you step-by-step through the process.

You'll start by logging into the course homepage.

Watch about 40 minute of training videos.

Reference our course textbook as needed.

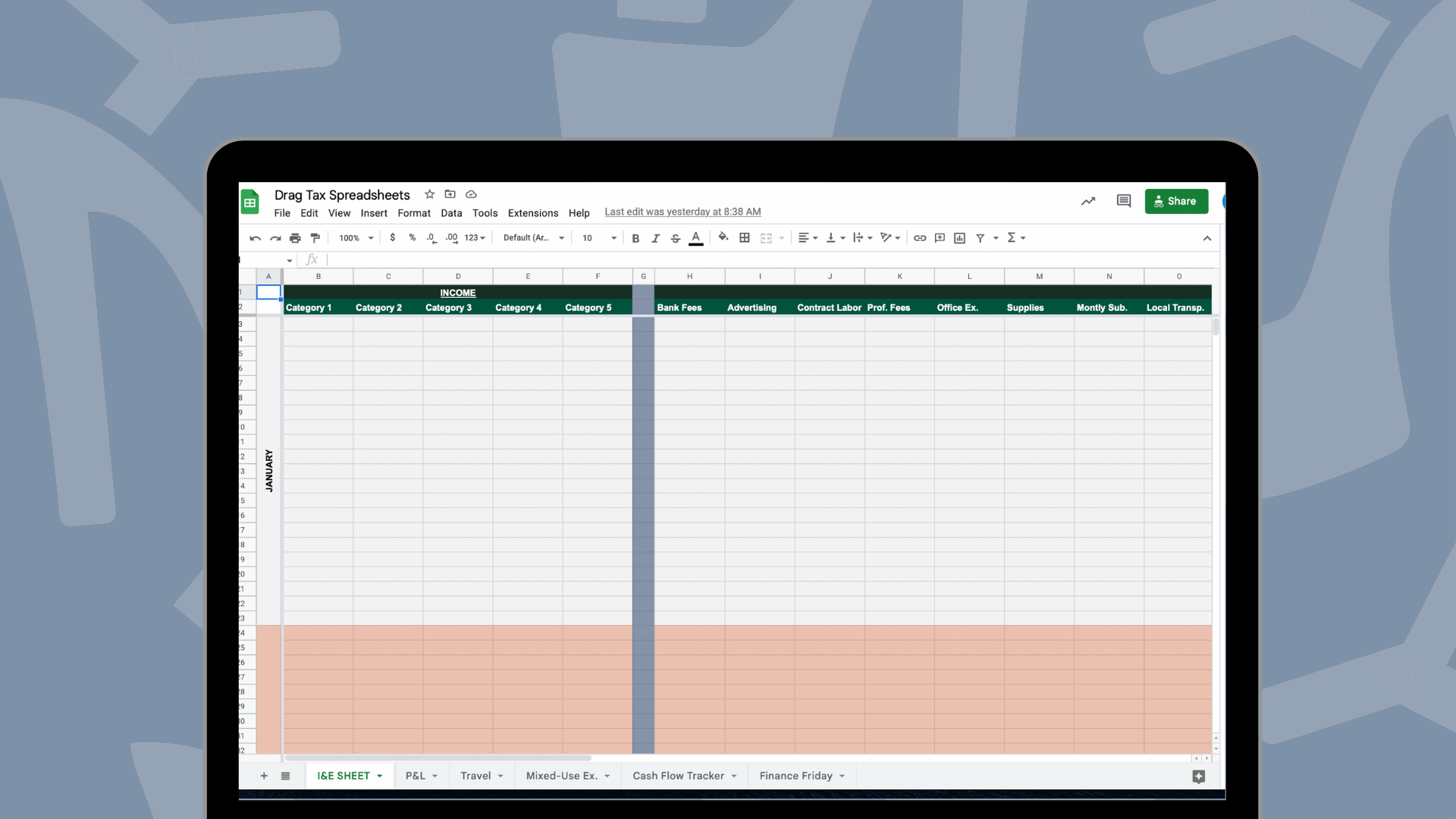

Use the spreadsheet template to track your numbers.

Why I created BOD Basics...

Knowing and tracking your numbers is so, so important.

You need to:

- Pay your quarterly taxes to keep the IRS off your back

- Know how much your making to make smart decisions

- Pay yourself on a regular basis

- And consider basic tax strategy so you don't overpay

Good systems will also make your life so much easier come tax season.

I know that not everyone is ready to outsource all their accounting,

but doesn't mean you shouldn't get help to at least to it right on your own. That's why I created this course.